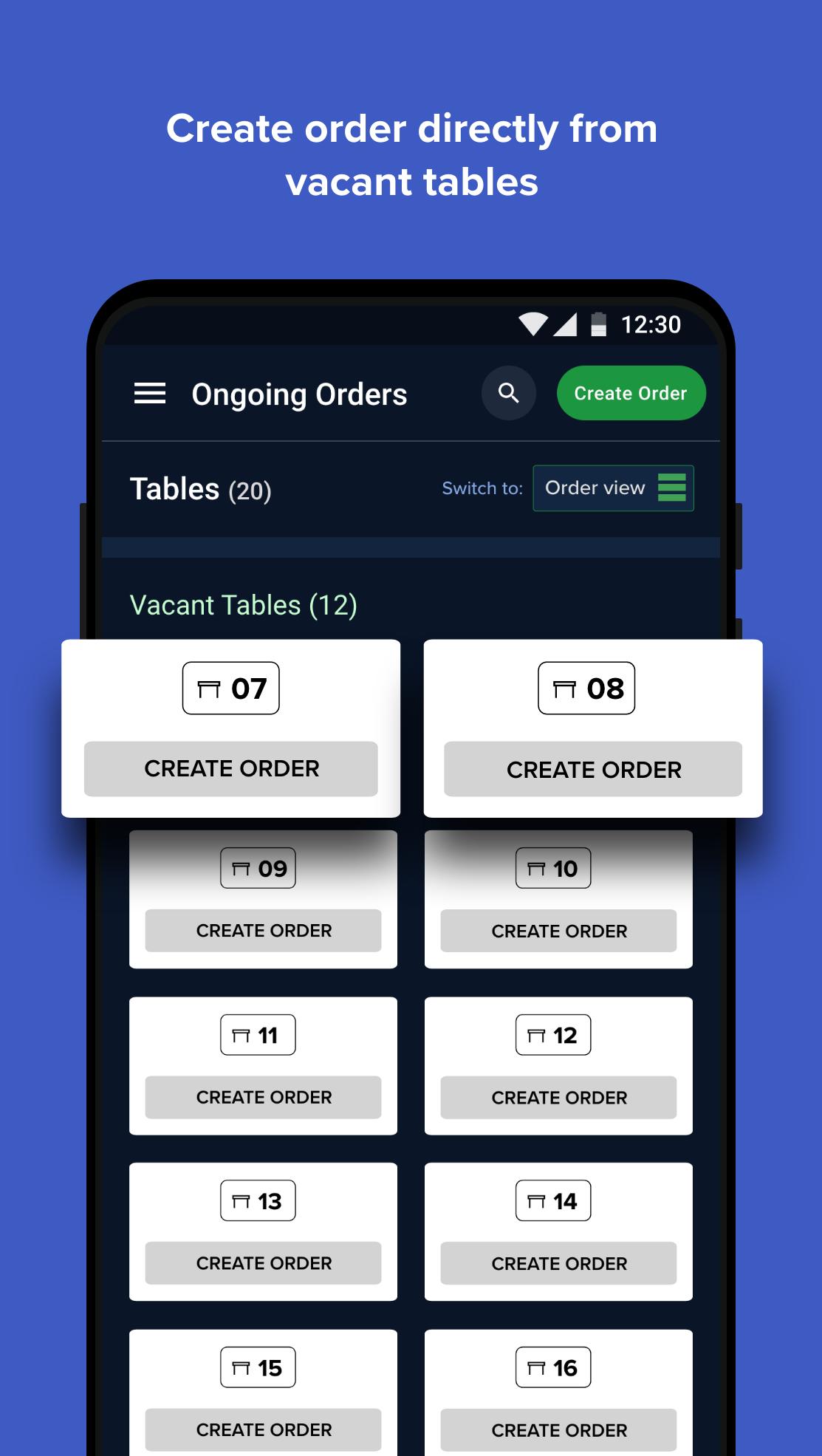

DotPe is a creative agency changing the face of digital payments by giving companies seamless, contactless modes of payment. With cutting-edge technology, it empowers retailers to provide the most seamless and effective payment experiences for increased sales and high customer satisfaction.

From digital ordering to real-time transaction tracking to making payments through QR codes, a wide array of services are at the very root of its success. Such qualities make it very easy for businesses of all sizes to easily accept the digital economy, be it a small shop or a multinational company.

The merchants can reduce issues related to traditional modes of payment through the platform, increase the pace of transactions, and decrease transaction times.

Table of Contents

What is DotPe?

In which industries and market niches does it operate?

The primary business models of are:

- Shop; E-commerce plugins

- Retail; In-store retail tech

DotPe Funding

What was the funding raised by DotPe in its recent funding round?

Since their latest investment round—a Series B round carried out on Sep 14, 2022—it has raised $58 million.

Total funding raised by DotPe

Across three waves, it has raised $93.5 million in investment.

Who are the lead investors in its latest investment round?

The lead investor in DotPe’s latest investment round, which closed on September 14, 2022, is Temasek.

How many investors does DotPe have?

- It has a total of 22 investors.Thirteen institutional investors include PayU and twelve more.

- The nine angel investors are Rohit Bansal and eight others.

Institutional investors in DotPe:

- A Singapore-based company, Temasek, invested its first dollar in DotPe at its Series B round on September 14, 2022.

- A Chiyoda-ku, Japan-based company, MUFG, invested its first dollar in DotPe at its Series B round on September 14, 2022.

- On February 6, 2020, PayU, an Indian company, based in Gurugram, first invested in DotPe in its Seed round.

- On February 6, 2020, Info Edge Ventures, an enterprise based in Noida, India, made its first investment in DotPe at the Seed round stage.

- On February 6, 2020, Beijing, China-based Fosun RZ Capital first invested in DotPe in its Seed round.

Founders

Its four founders are:

Shailaz Nag,

- Chief Executive Officer and co-founder of DotPe, along with three other companies.

- Angel investor for two companies

- Chief at DotPe

Anurag Gupta,

- Co-founder of one more startup

- Angel investor for two companies

- Director at DotPe and Board member of one other company

Gyanesh Sharma,

- Director of DotPe

- co-founder of one other company

Pragati Mathur,

- Director of DotPe

- Co-founder of one other company

How does it compare to its rivals?

It ranks 25th out of 3353 rivals. BigCommerce, Bazaarvoice, and CallidusCloud are some of the rivals.

How many businesses compete with DotPe?

- There are 3353 competitors.

- 2755 of them are still alive.

- 279 have raised, and 230 have failed.

Who are the latest competitors?

Productico, Bringmal, and ShopperBuild are the latest competitors of it.

How is the share structure of DotPe as of the latest Cap Tables?

- Funds own 56.78% of DotPe’s shares,

- the founder owns 29.63%,

- Enterprise owns 8.52%,

- Angel owns 2.03%

Due to its user-friendly and highly secure features, it has garnered plenty of interest and trust from businesses and customers. The fintech firm has the potential to be a big player in the market, with excellent market penetration and rapid expansion.

This speaks for its innovative customer-centric solutions, owing to which it is very well placed for further growth and adaptation to the changing trends of the industry. On its way to change how people make a payment, it leads from the front in the global digital payment revolution, speeding up the shift toward a cashless future.

1 thought on “DotPe: An Innovative Startup”